Changing accounting systems is costly and time consuming. So why do companies do it? Usually it is because the company has grown, become more complex to manage and better data is needed to support decision making.

Changing accounting systems is costly and time consuming. So why do companies do it? Usually it is because the company has grown, become more complex to manage and better data is needed to support decision making.

This generalized statement can be broken down to specific areas of need within the business. The most often change drivers are:

- Multiple business units are created and need to be tracked.

- Inventory has become larger and more complex to manage.

- Multiple products/services are offered and profitability measurement of each is needed.

- Complex cost structure needs more detailed data to be managed effectively.

- Increased regulatory reporting requirements can’t be handled.

- Improved forecasting and financial modelling are needed.

Early stage companies and small companies can use simple, cloud based bookkeeping systems to manage their payables, bank reconciliation, payroll and accounts receivable. There are add-on solutions to manage projects, track inventory and track customers. These rapidly become insufficient when companies grow beyond just bookkeeping.

Microsoft, NetSuite and several industry specific packages are offered on a SaaS basis which greatly reduces the investment in moving from bookkeeping to more complex accounting. Which system you should use is specific to your business and industry. Some systems will have features that are specific to your industry and industry trade groups often can tell you what the most commonly used system is in your industry. Using a custom designed system will always be more expensive than general use business systems.

The decision on changing systems should start with determining your unmet needs and prioritizing them. In IT jargon, this is setting your requirements definitions. Ask yourself these questions:

- What information do you need to make your company more profitable?

- What information do you need to update your strategies?

- What information do you need to keep up with regulatory reporting?

- What information do you need to forecast growth capital needs?

- What information do you need to make your people more productive?

If you can answer these questions and your current systems don’t support these needs, it’s time to upgrade your systems. If you can’t answer these questions, we can help you.

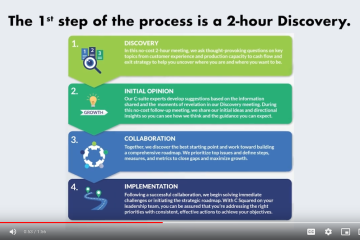

C Squared Solutions offer fractional CFOs and COOs for growing businesses. We have successful track records in helping owners answer the questions above. Give us a call and let’s discuss your concerns.